FREE & QUICK WORLDWIDE SHIPPING ON $60+

TAKE 10% OFF YOUR ORDER | USE CODE: TAKE10

-

1716p.

1716p.

-

Softcover

Softcover

-

English language

English language

-

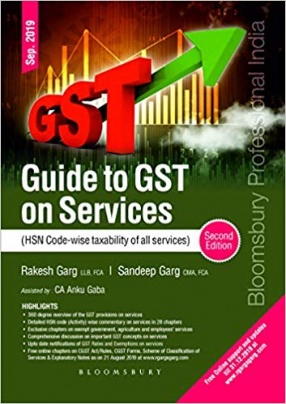

Bloomsbury Pub. India

Bloomsbury Pub. India

-

05.10.2019

05.10.2019

-

ISBN 13:

9789389449136

ISBN 13:

9789389449136

Guide to GST On Services: HSN Code Wise Taxability of all Services

Contents: Part A: Concepts of GST (Services) – Chapters A-1 to A-22 cover general provisions relating to services, such as, meaning and scope of supply, time, value and place of supply, levy & reverse charge, composition, input tax, export and refund, registration, accounts etc. Part B: HSN Code wise Guide on Services – Chapters B-1 to B-28 comprises of critical analysis of HSN Code wise services through illustrations and tables. Part C: Rates – Chapters containing upto date notifications of Service Tax Rates and Exemptions Part D: Online Chapters – Online chapters on CGST Act/Rules and IGST Act/Rules, Scheme of Classification of Services and Explanatory Notes as on 01.08.2019 available at www.rgargsgarg.com The overarching purpose of the book is to provide a 360 degree overview of the GST provisions on services for easy understanding and quick reference of professionals.